LIC Jeevan Kiran Plan 870

LIC Jeevan Kiran Plan 870

LIC Jeevan Kiran Plan 870 - Premium and Maturity Calculator

LIC Jeevan Kiran Plan 870

LIC Jeevan Kiran Plan 870 is a term insurance plan with returns of all premium

Description

LIC Jeevan Kiran Plan 870

LIC Jeevan Kiran Plan 870 - Life Insurance Corporation of India (LIC) has launched a new term plan named Jeevan Kiran Table Number- 870. This is a term insurance plan best suited for working individuals who have dependent children and parents. This plan provides family protection against death due to uncertainties of the policy holder at a very low premium.

"LIC’s Jeevan Kiran 870 is a non-linked, non-participating, individual, pure term insurance plan,” Under LIC Jeevan Kiran Plan 870, the policy holder receives back all the premium paid in case he/she survives the end of policy term, LIC of India has launched this scheme on 27th, July 2023.

Please Note: You can now buy online LIC Jeevan Kiran plan 870 through credit card/debit card, net banking, upi and wallets on our LIC's New Business Platform.

Key features LIC Jeevan Kiran Plan 870

Flexibility to choose from two benefit options: Single Premium and Regular Premium

- Choose from Single Premium and Regular Premium Payment.

- settlement option on maturity or death available for 5 years installments.

- Choose the period for which protection is required.

- Benefit of attractive High Sum Assured Rebate.

- categories of premium rates namely

-

(1) Non-Smoker rates and

-

(2) Smoker rates

- Option to choose accidental and disability benefits by opting for Accident Benefit Rider and disability on payment of additional premium for the rider benefit.

Eligibility Conditions and Other Restrictions:

| Particulars | Minimum | Maximum |

|---|---|---|

| Age at Entry | 18 years (Last Birthday) | 65 years (Last Birthday) |

| Maturity Age | 28 years (Last Birthday) | 80 years (Last Birthday) |

| Policy Term | 10 years | 40 years |

| Basic Sum Assured | Rs. 15 Lakhs | No Limit |

| Premium Payment Options | Regular Premium : Same as policy term Single Premium : Single Payment |

|

| Minimum Premium | Regular Premium - Rs. 3,000/- Single Premium - Rs. 30,000/- |

|

| Premium payment mode | Single/yearly only/half yearly |

Also read this » LIC life time plan with maturity

REBATES/LOADINGS:

The following rebates/loadings shall be applicable:

(1) High Sum Assured Rebate

The High Sum Assured rebates are as under:

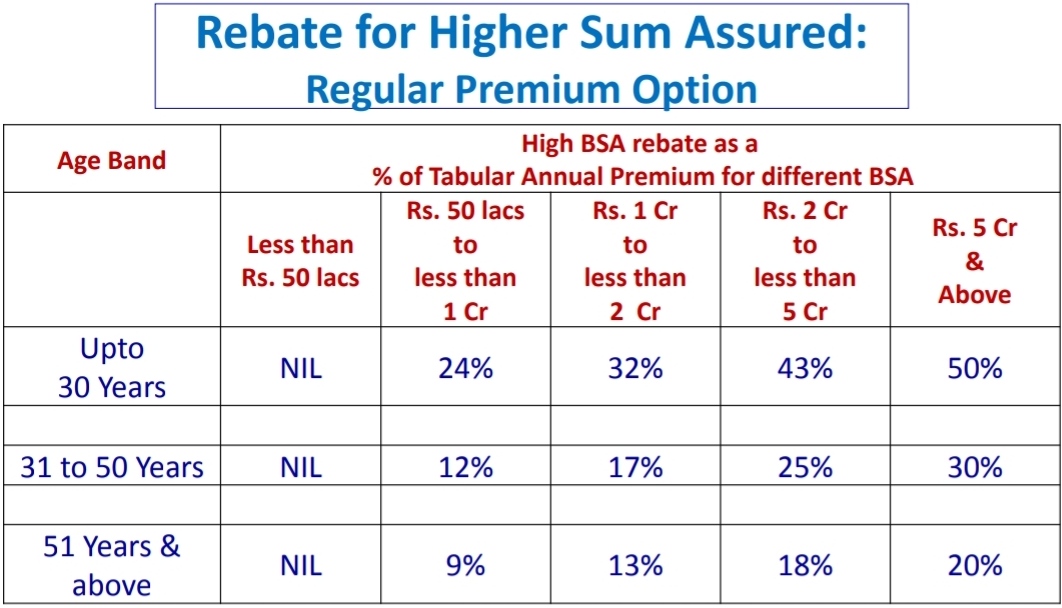

(a) Under Regular Premium payment:

The rebate for high Basic Sum Assured (BSA) as a % of Tabular Annual Premium is as under:

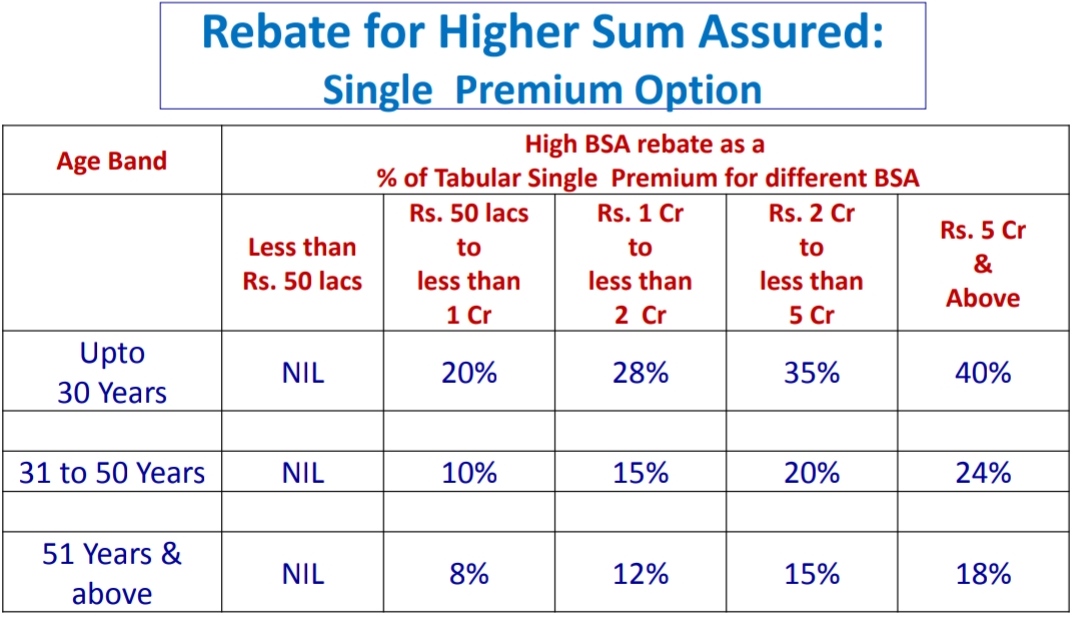

(b) Under Single Premium Payment:

The rebate for high Basic Sum Assured as a % of Tabular Single Premium is as under:

(2) Mode Loading (applicable for Regular Premium payment):

| Mode | Loading as a % of Tabular annual premium |

|---|---|

| Yearly | Nil |

| Half-Yearly | 2% |

Benefits:

Benefits payable under an in-force policy shall be as under:

Death Benefit:

Death benefit payable on death of the Life Assured during the policy

term after the date of commencement of risk but before the date of

maturity

provided the policy is in force and claim is admissible shall be “Sum Assured on Death”.

For Regular premium payment policy, “Sum Assured on Death” is defined as the highest of:

- 7 times of Annualized Premium; or

- 105% of “Total Premiums Paid” up to the date of death

- Basic Sum Assured

For Single premium policy, “Sum Assured on Death” is defined as the higher of:

- 125% of Single Premium; or

- Basic Sum Assured on Death

Maturity Benefit:

On Maturity- survival of the life assured to the end of the policy term, maturity sum assured equal to Total Regular/ single premium OR 105% Total premium paid.

How Does LIC Term insurance Policy 870 with Return of Premium Work? With example

Let's understand how LIC Jeevan kiran policy 870 with return of premium works:

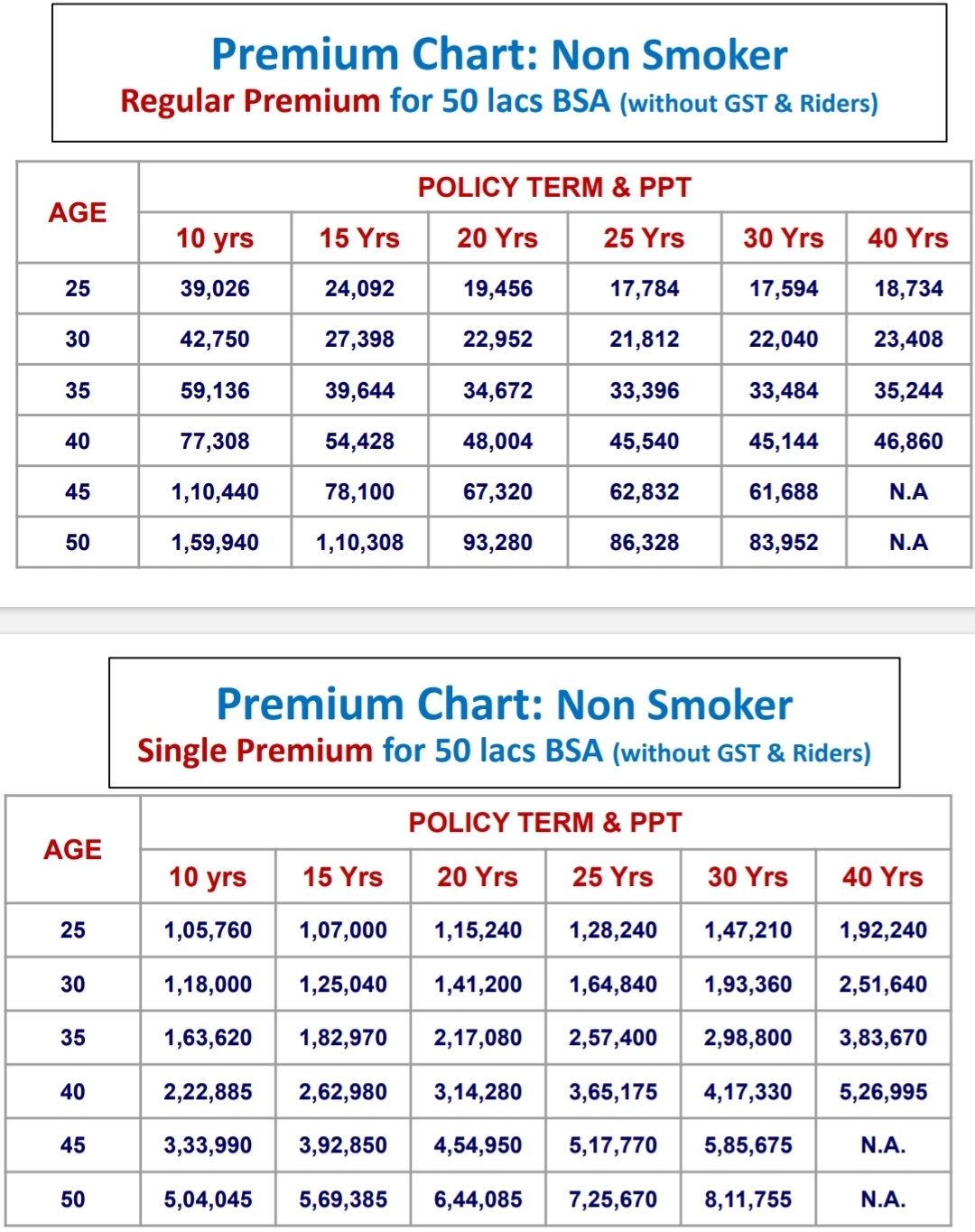

Mr. Mohan is a 30 years old man buy this plan to secure their family, Mohan is healthy, and active without any history of medical problems or smoking habits. He buys LIC's term insurance plan 870 with return of premium and chooses a sum assured amount of Rs. 50 Lakhs.

The yearly premium that is payable for the plan is Rs. 22952 for a tenure of 20 years. If Mr. Mohan died within the policy term, the individual within the policy term, the beneficiary/nominee will receive the sum assured amount of Rs. 50 Lakhs. But if Mr, Ram survives the policy tenure, he will be eligible for a maturity payout under the 'LIC term insurance plan 870' with return of premium. He will get (Rs. 22952 X 20) i.e., 4,59,052 upon maturity of the plan.

Also read this » LIC best money back plan

LIC Jeevan Kiran Plan 870 Premium Chart

LIC Jeevan Kiran Plan 870 Premium Chart for Non Smoker

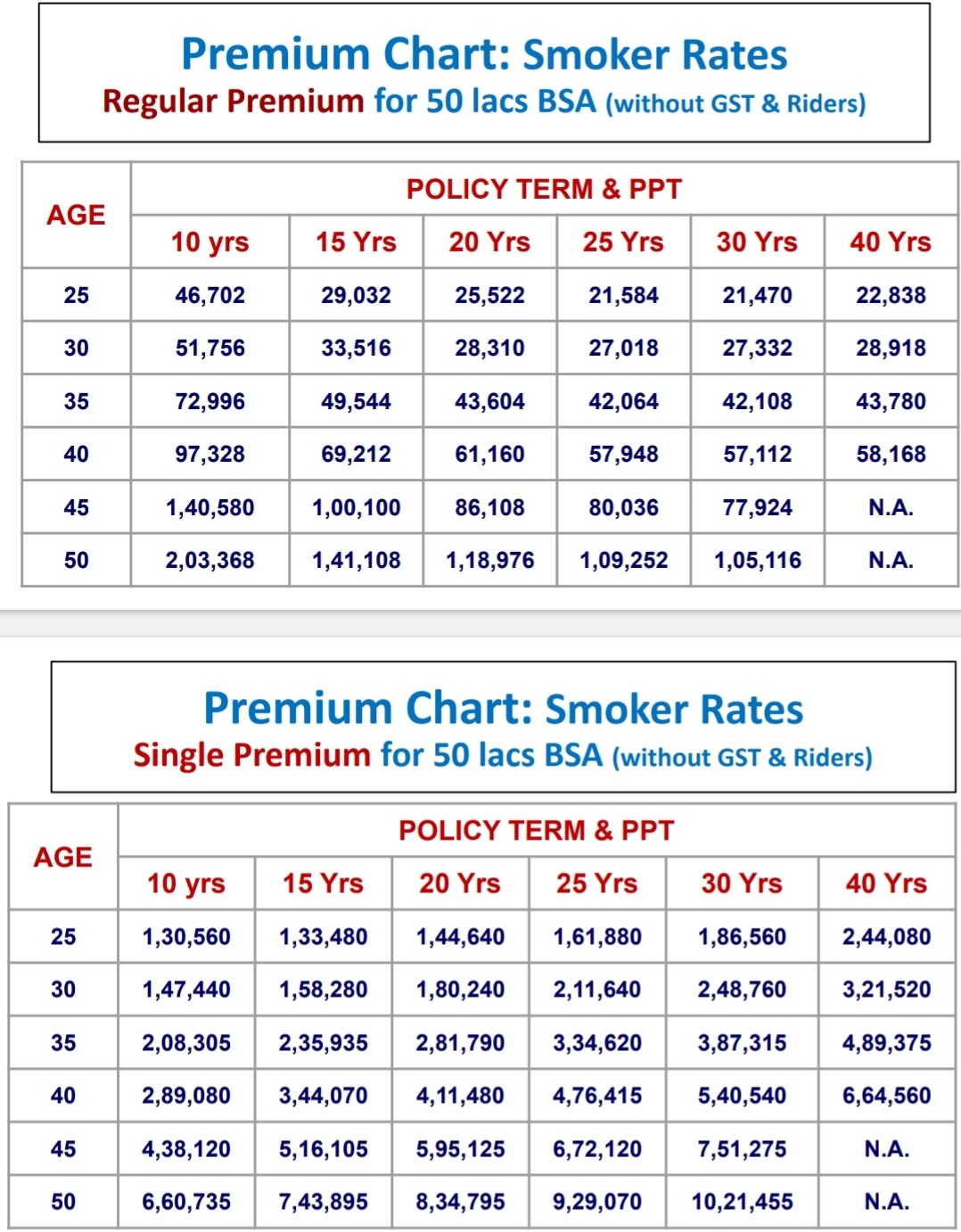

LIC Jeevan Kiran Plan 870 Premium Chart for Smoker

Other Features

Tax Benefits - This plan will have benefits under Section 80C and Section 10 (10D).

Policy revival- within 5 years of FUP.

Free look Period - if the policyholder is not convinced with the terms and conditions of the policy, she/he can cancel the policy within 15 days from the receipt of the policy document.

GRACE PERIOD (APPLICABLE FOR REGULAR PREMIUM PAYMENT): A grace period of 30 days will be allowed for payment of yearly or half-yearly premiums from the date of First Unpaid Premium during this period.

The policy shall be considered inforce with the risk cover without any interruption as per the terms of the policy, If the premium is not paid before the expiry of the days of grace, the Policy lapses

SURRENDER: Under Regular Premium during the policy term provided two full years’ premiums have been paid. Under Single Premium payment, the policy can be surrendered by the policyholder at any time during the policy term.

The Surrender Value payable shall be higher of Guaranteed Surrender value (GSV) and Special Surrender Value (SSV).

POLICY LOAN: No Loan will be available under this plan.

Comments & Reviews

Yash Wrote:

2024-02-16 14:44:47

Pure term plan for 48 years man covered for 80/85 year and 10 pay with GST please share on mentioned email or write below

Write Your Reply

Prakash Wrote:

2024-01-30 09:02:07

ಸರ್ ವಯಸ್ಸು 41ವರ್ಷ ನಾನು ಧೂಮಪಾನಿ ನನಗೆ 1 ಕೋಟಿ ವಿಮಾ ಮೊತ್ತ ಬೇಕಾಗಿದೆ ಪ್ರಿಮಿಯಂ ಪಾವತಿ 20 ವರ್ಷ ಇದರ ಸಂಪೂರ್ಣ ವಿವರ ತಿಳಿಸಿ

Write Your Reply

Singaraj Wrote:

2023-12-22 14:04:57

IT return compulsory for purchase Jeevan kiran policy.pls advice

Write Your Reply

Manish pandey Wrote:

2023-12-14 15:35:52

Can a merchant Navy person / seafarers can take this plan. What happen in can accident our death will occur out of India.

Write Your Reply

M i Wrote:

2023-12-03 12:39:19

Age 38, which lic policy is best for term insurance plan 2023. Coverage should be maximum and all benefits. Plz reply

Write Your Reply

NITYANANDA BEHERA Wrote:

2023-11-06 16:41:07

SIR POLICY MATURE HONEKE BAAT AGAR DEATH HO JAAYE......KYA NOMINEE KO PAISA MILEGA......

Write Your Reply

K K Venkatesh Wrote:

2023-09-25 03:01:54

Is Minimum Sum Assured for 10,00,000=00 is available in this policy.

Write Your Reply

Mahesh Patel Wrote:

2023-09-14 02:04:09

Lic Advisor

Ankit Arora Wrote:

2023-12-03 06:12:26

नमस्कार सर मैंने जीवन किरण पालिसी लेने का मन बनाया है,मेरी उम्र 38 है,मैं 30 वर्षो के लिए 20 लाख की ये पोलिसी लेना चाहता हूँ।स्मोकिंग नही करता हूँ।यहाँ पालिसी कैलक्यूलेटर के माध्यम से देखा कि मेरी छमाही प्रीमियम 10 हजार के लगभग है,फिर उसी कैलक्युलेटर के माध्यम से देखा तो मेरा सम अशुअर्ड अमाउंट पहले वर्ष में ही अगर मेरी मृत्यु हो जाती है तो 20 लाख है। फिर लेकिन जब वहीं वेब साईट पे ये वार्षिक प्रीमियम का 7 गुणा या कुल देय प्रीमियम का 125% वाली बात समझ मे नही आई,मतलब पालिसी शुरू करने के 2 वर्ष बाद अगर मृत्यु हो जाय तो वार्षिक प्रीमियम(20हजार जो मेरा होगा) उसका 7 गुना यानी 2लाख 80 हजार मिलेगा? या कुल देय प्रीमियम 40 हजार का 105% मतलब 42 हजार मिलेगा? कृपया इसे स्पष्ट करने की कृपा करें।

Jyotsna Rani Nath Wrote:

2023-11-05 02:03:13

My mother age 53 wants a term life insurance plan of about 50 lakhs

Write Your Reply

Vilas Deshmukh Wrote:

2023-09-04 04:47:06

I wish purchase the policy for Rs.15 Lakh upto the age of 80Years, at present my age is 63 years. How much premium Half yearly & Yearly. Please contact on 9423175388.

shabbir Wrote:

2023-09-20 02:28:45

how to calculate premium

Write Your Reply

S. H. Pasad Wrote:

2023-08-30 04:29:22

Send bulletin..very nice plan suitable to every person and need. Riders may be charging more, but features are good.

Write Your Reply

RAKESH GUPTA Wrote:

2023-08-22 02:14:30

Jeevan kiran policy rs.20 lac dob 01.01.1960 why premium regular yearly

Write Your Reply

Deo Chandra Thakur Wrote:

2023-08-21 22:41:12

Hi, I want to know the new Jeevan Kiran term insurance plan. Details are- Age- 40 Yrs Sum Assured- 1 Cr Premium Pay- 40 Yrs Non Smoker Kindly let me know the details breakup and benefits of it. Please share pdf.

Sunil Kumar Wrote:

2023-09-14 02:07:33

Sir your premium will be 45263 half yearly +GST (47320) and 88395 yearly +GST (92373) FOR 1sr year and 46281& 90384 for rest. In return you will get 3535800(35+ lakh) at maturity. You can contact on 9355729499

Write Your Reply

BBH Wrote:

2023-08-20 10:38:03

49 years of age lic jeevan kiran policy ..pls share single premium & also regular yearly premium

Write Your Reply

Rajamoor Bheemsen Wrote:

2023-08-14 01:35:52

Sir my date of birth 12/07/1967 Iam take this policy

Write Your Reply

ram Wrote:

2023-08-13 00:24:19

Lice jeevan kiran table no 870, What should be the salary of the year, if the annual income is 200000 then can we take the policy

Write Your Reply

Ankush Wrote:

2023-08-10 07:33:33

Age 37 Single premium option one time payment only SA 1Cr and 50lac How much itr required for 1cr and 50lac

Write Your Reply

NIRANJAN KUMAR BANDYOPADHYAY Wrote:

2023-07-31 02:40:13

TABLE NO. 870 MAXIMUM ACCIDENT AMOUNT

Parveen Kumar Wrote:

2023-08-02 08:26:48

Sir my age 56 terms kya plan m

kailash Wrote:

2023-08-02 03:27:58

Suicide will cover under this plan??????....... if yes please mention duration time.

Maya Wrote:

2023-07-31 03:59:45

Maximum accidental limit is 1 crore under jeevan kiran plan 870.

Write Your Reply

chandan sutradhar Wrote:

2023-07-29 09:25:54

my age 50 year i want to enter jeevan kiran for sum assured inr 25lac for 30 years single premium how much premium amount

Gajanan Ramrao Ingle Wrote:

2023-07-30 10:58:01

My DOB is 24/05/1980.Term period should be 30year for 50 lac.How much premium should I pay

Vivek Gupta Wrote:

2023-07-29 13:45:05

Please sir contact me on this number I will send you all details #8574135517#

Chandan Singh Wrote:

2023-07-29 10:02:12

Hi Chandan, For an Sum insured of INR 25Lac for 30 Years, Premium will be : First Year Premium Yearly 49847 half Yearly 25422 Subsequent Year Premiums Yearly 48773 half Yearly 24874 Please connect with me at 886 008 7658 for more details and if you wish to take this policy to whatsapp me click here https://api.whatsapp.com/send?phone=918860087658

Dattatraya Ganpat Kharat Wrote:

2023-07-29 09:45:17

Age 50. 25lakh, 30 yr, premium rs,52459 for yr, including GST 4.5%. details.9824104762

Write Your Reply

GAUTAM SINGH Wrote:

2023-07-28 22:54:21

Hi, what are the documents required for this policy. ty

Kalyan Singh Wrote:

2023-08-02 09:42:57

Mere pass document Aadhar card pan card hai please help me Bima

Dattatraya Ganpat Kharat Wrote:

2023-07-29 09:41:46

Photo, pan card, Aadhar card, or passport, last 3yr, ITR with computation of income. And kyc.required medical. Complsary

Write Your Reply

P c Gupta Wrote:

2023-07-28 21:55:22

Send annual premium at age of 64 for 16 year for 15 lac undet table 870

Pentakota Chandrasuryanarayana Wrote:

2023-07-29 11:13:26

Fifty lakh policy, how much premium? and how much period ?

Latika kharat insurance advisor Wrote:

2023-07-29 09:33:02

Premium for age 64 for 16yr for 15lac. Premium Rs.82278 including GST 4.5%. More details. 9823104762

Write Your Reply

Prakash Kumar Wrote:

2023-07-28 20:08:11

Is there surrender value in this plan

Sohan Wrote:

2023-07-29 03:15:06

Yes if you choose single premium mode

Sohan Wrote:

2023-07-29 03:15:01

Yes if you choose single premium mode

Write Your Reply

Sanjiv Kalkar Wrote:

2023-07-28 09:09:41

Policy Jeevan Kiran no.870 seems to be good. *Disability Benefits not seen. Required Information. *If Monthly Scheme of 3000/- Rs. Planned shall it be ok. *My Age 52 Years old. Birth Date Nov 1971 what could be EMI Monthly. Affordable 3000/- Rs.only *Required Closing Option if not Possible to Pay Premium & what could be the returns. Thanks ???? regards, Sanjiv Kalkar Panvel 9767100746 pkalkar1@gmail.com Give details in English & Marathi along with 10 High Lights.

Dattatraya Ganpat Kharat Wrote:

2023-07-29 09:38:21

No monthly premium. Rs.3000 minimum premium just for illustration. You can pay half yearly or yearly premium. More details. 9823104762

Prasad Wrote:

2023-07-28 20:16:17

You may please call me for term insurance of TATA AIA

Write Your Reply

KJ Venkatesh Wrote:

2023-07-28 08:46:07

If informed shall be interested

Prasad Wrote:

2023-07-28 20:19:19

Pl contact me at 9492913985

Prasad Wrote:

2023-07-28 20:17:49

Pl contact me at 9492913985

Write Your Reply

Chetan Wrote:

2023-07-27 06:23:00

I m.interest

Prasad Wrote:

2023-07-28 20:19:10

Pl contact me at 9492913985

Write Your Reply

Write Comment & Reviews

LIC Plan (Buy Online)

- LIC Nivesh Plus 849

- LIC SIIP ULIP Plan 852

- LIC Saral Jeevan Bima Plan 859

- LIC Dhan Rekha Plan 863

- LIC Bima Ratna Plan 864

- LIC New Pension Plus 867

- LIC Jeevan Azad Plan 868

- LIC Dhan Vriddhi Plan 869

- LIC Jeevan Kiran Plan 870

- LIC Jeevan Utsav Plan 871

- LIC Jeevan Dhara-2 Plan 872

- LIC Index Plus Plan 873

- LIC Amritbaal Plan 874

- LIC Arogya Rakshak Plan 906

- LIC new endowment 914

- LIC New Jeevan Anand 915

- LIC New Bima Bachat 916

- LIC Single Premium Endowment 917

- LIC New Money Back 920

- LIC New Money Back Plan 921

- LIC New Children’s Money Back Plan 932

- LIC Jeevan Lakshya 933

- LIC Jeevan Tarun 934

- LIC Jeevan Labh Plan 936

- Aadhar Stambh (943)

- Aadhar Shila (944)

- LIC Jeevan Umang 945

- LIC Jeevan Shiromani 947

- LIC Bima Shree 948

- LIC’s Micro Bachat Plan (951)

Plan Type

- LIC Endowment Plans

- LIC Single Premium Plans

- LIC Money Back Plans

- LIC Whole Life Insurance Plans

- LIC Children Plans

- LIC Limited Premium Endowment Plans

- LIC Pension Plans

- LIC Term Insurance Plans

- LIC Unit Linked Insurance Plans (ULIP)

- LIC Health Insurance Plans

- LIC Micro Insurance Plans

- LIC Closed Plans