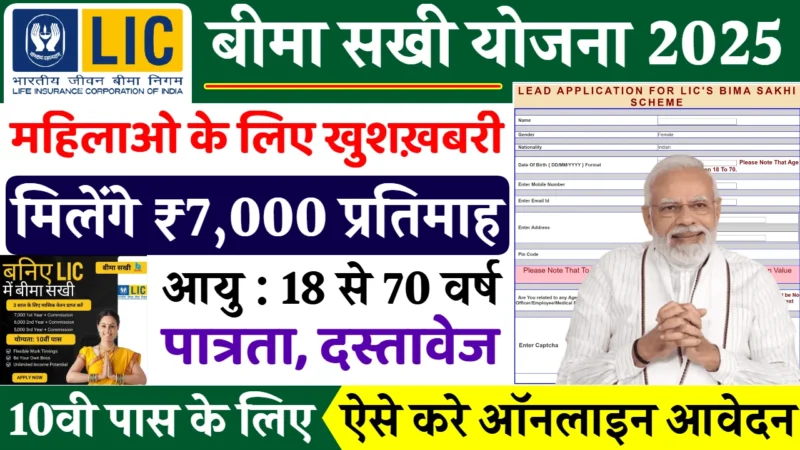

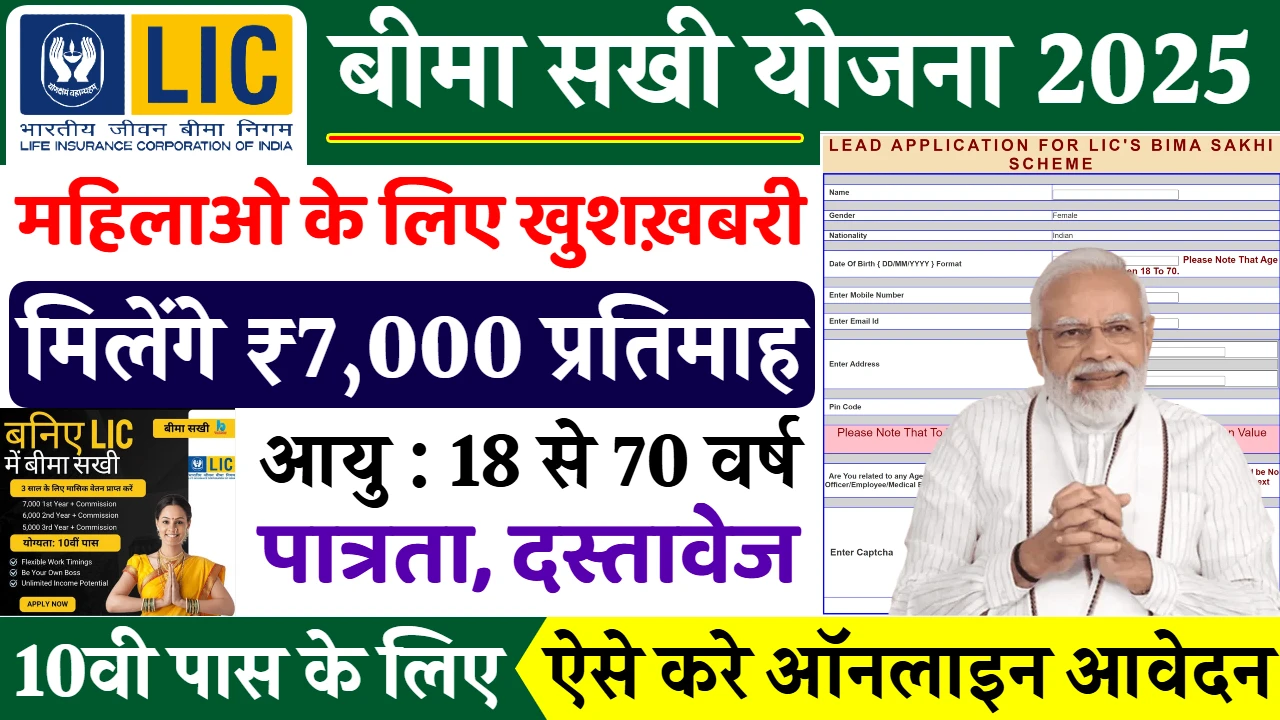

Bima Sakhi Yojana 2025: Women to Get ₹7,000 Monthly – Benefits, Eligibility & Apply Online

LIC Bima Sakhi Yojana 2025: Learn everything about the LIC Bima Sakhi Yojana 2025 – eligibility, benefits, documents, online/offline application process, and how women can receive ₹7,000 every month.

🌸 Introduction – A Step Towards Women’s Financial Freedom

For generations, Indian women have played a crucial role in managing households and contributing silently to the economy. Yet, financial independence often remains a dream for many. Recognizing this gap, the Life Insurance Corporation of India (LIC) has introduced a new scheme in 2025 – LIC Bima Sakhi Yojana.

This scheme is not just about money. It is about dignity, empowerment, and security. Under this plan, women can receive ₹7,000 every month, ensuring a stable income that helps them take care of themselves and their families without depending on others.

In this blog, we’ll explore everything about the scheme – benefits, eligibility, documents, application process, and a real-life example of how you can get the promised monthly income.

🌟 What is LIC Bima Sakhi Yojana 2025?

The LIC Bima Sakhi Yojana 2025 is a women-centric financial scheme designed to provide fixed monthly support of ₹7,000. The primary goal of this plan is to help women become financially independent and ensure they have a steady source of income.

It works like a pension plan where women either pay a premium (investment) or qualify through government-backed support. After fulfilling the conditions, they start receiving ₹7,000 every month directly into their bank account.

This initiative is specially targeted towards:

- Housewives

- Working women planning for retirement

- Widows or single mothers

- Women from economically weaker sections

📌 Key Highlights of LIC Bima Sakhi Yojana 2025

Here’s a quick glance at the main features:

- 💰 Monthly Income: ₹7,000 every month

- 👩 For Women Only: Exclusively designed for female applicants

- 🏦 Secure Plan: Backed by LIC, India’s most trusted insurance company

- 🧾 Flexible Entry Age: Usually 18 to 55 years (varies as per policy details)

- ⏳ Payout Mode: Direct transfer to bank account

- 🔒 Safety Net: Ensures lifelong support or for a fixed term (depending on plan option chosen)

💎 Benefits of LIC Bima Sakhi Yojana

- Financial Independence: Women get a regular monthly income of ₹7,000.

- Secure Retirement: Helps women plan for old age with guaranteed income.

- Empowerment: Reduces dependency on family members.

- Tax Savings: Premiums paid (if applicable) are eligible for tax benefits under Section 80C.

- Bank Transfer Facility: Direct credit to account for hassle-free access.

- Life Cover Option: Some variants also provide insurance coverage along with pension.

✅ Eligibility Criteria

To apply for LIC Bima Sakhi Yojana 2025, women need to meet certain conditions:

- Applicant must be a woman (Indian citizen).

- Minimum Age: 18 years

- Maximum Age: 55 years (varies by plan)

- Must have a valid bank account linked with Aadhaar.

- Should be willing to pay the required premium/initial contribution (if applicable).

🗂 Documents Required

Women applying for this scheme must submit the following documents:

- Aadhaar Card (Identity Proof)

- PAN Card

- Address Proof (Voter ID / Ration Card / Utility Bill)

- Age Proof (Birth Certificate / School Certificate)

- Passport Size Photographs

- Bank Account Passbook / Details

- Mobile Number & Email ID

🖥 How to Apply for LIC Bima Sakhi Yojana 2025?

Women can apply for this scheme in two ways – online and offline.

🔹 Online Application Process:

- Visit the official LIC website.

- Search for Bima Sakhi Yojana 2025 under schemes.

- Click on Apply Online.

- Fill in your personal details (name, DOB, Aadhaar, PAN, etc.).

- Upload the required documents.

- Pay the premium/initial deposit (if required).

- Submit the application – you’ll get a confirmation SMS/email.

🔹 Offline Application Process:

- Visit your nearest LIC branch or contact an LIC agent.

- Collect the application form for Bima Sakhi Yojana 2025.

- Fill the form and attach necessary documents.

- Submit it at the LIC office.

- After verification, you’ll get an acknowledgment slip.

📊 Example – How Will You Get ₹7,000 Every Month?

Let’s understand this with an example:

| Particulars | Details |

|---|---|

| Applicant | Mrs. Seema, Age 40 |

| Contribution (Premium) | ₹10,00,000 (one-time) |

| Payout Start Age | 50 years |

| Monthly Income | ₹7,000 |

| Total Annual Income | ₹84,000 |

| Lifetime Income (20 years) | ₹16,80,000 |

👉 This means if Mrs. Seema invests today, she will start receiving ₹7,000 per month after maturity, directly in her bank account.

🌍 Why LIC Introduced This Scheme?

- To empower women financially

- To reduce dependency on husbands/families

- To encourage savings & financial planning among women

- To support women from middle-class and economically weaker backgrounds

🔄 Comparison with Other Schemes

| Scheme | Monthly Benefit | For Whom |

|---|---|---|

| LIC Bima Sakhi Yojana 2025 | ₹7,000 | Exclusively for Women |

| LIC Jeevan Akshay | Variable | Open for All |

| Atal Pension Yojana | ₹1,000 – ₹5,000 | Men & Women (general) |

| LIC Jeevan Shanti | Depends on Investment | Open for All |

Clearly, LIC Bima Sakhi Yojana stands out as it is women-focused with a guaranteed ₹7,000 monthly payout.

👩 Who Should Apply for This Plan?

- Homemakers wanting financial security

- Working women planning retirement income

- Widows / single mothers needing fixed monthly support

- Women investors seeking tax benefits & assured income

⚖ Pros & Cons of LIC Bima Sakhi Yojana

✅ Pros

- Guaranteed ₹7,000 income every month

- Backed by LIC’s trust & security

- Exclusively for women

- Helps with savings + retirement planning

❌ Cons

- May require a large initial investment

- Payout fixed at ₹7,000 (inflation not considered)

- Limited flexibility compared to market-linked schemes

📢 Expert Insights

Financial planners believe that LIC Bima Sakhi Yojana 2025 will play a vital role in strengthening women’s financial independence.

- Analysts highlight that fixed income plans are highly useful for housewives and retirees.

- Experts suggest women combine this scheme with other investments like PPF, FD, or mutual funds for better long-term wealth.

❓ FAQs (Frequently Asked Questions)

Q1. What is the monthly benefit of LIC Bima Sakhi Yojana 2025?

👉 Women will receive ₹7,000 every month.

Q2. Who can apply for this scheme?

👉 Only women applicants aged 18–55 years.

Q3. Is this scheme government-backed?

👉 Yes, it is introduced by LIC, a government-owned corporation.

Q4. Do I need to pay money to join?

👉 Yes, you need to make a one-time investment or regular premium (amount depends on plan choice).

Q5. How will I receive the money?

👉 The amount will be directly credited to your bank account every month.

Q6. Can I apply offline?

👉 Yes, by visiting the nearest LIC office or agent.

🏁 Conclusion – A Secure Future for Women

The LIC Bima Sakhi Yojana 2025 is more than just a financial plan – it’s a step towards women’s empowerment. With a guaranteed ₹7,000 monthly income, women can manage their expenses, secure their future, and live with dignity.

If you are a woman looking for financial security, or if you want to gift your mother, wife, or sister a safe income plan, this scheme can be the perfect choice.

💡 Final Tip: Always consult with an LIC advisor before finalizing the plan to understand the exact premium and benefits for your age group.